The Aegon Workplace Default fund is designed to grow employee savings over the long-term by investing in a diversified mix of investments. Six years before their target retirement date, the fund gradually and automatically moves into less risky investments. The process is designed to suit schemes that believe most employees will stay invested at retirement, but may have differing retirement income needs.

See how we explain the fund:

Key features

Single fund solution

A whole investment portfolio in a single fund, that automatically adjusts as retirement nears, preparing savings to provide a retirement income.

Diversified

Helping to spread investment risk across a range of asset types and regions.

Good value

Low fund charge of just 0.05%, paid in addition to the annual management charge, meaning more of members’ money goes towards saving for their future.

Robust governance

Backed by our Funds Promise, we check the fund follows the stated objective and that as the market, and members needs evolve, the fund does too.

Considers ESG factors

We've reduced the fund's carbon footprint by 36% since 2020¹ by integrating environmental, social and governance (ESG) considerations into its investment process. (As at 30 June 2023).

How the Aegon Workplace Default fund works

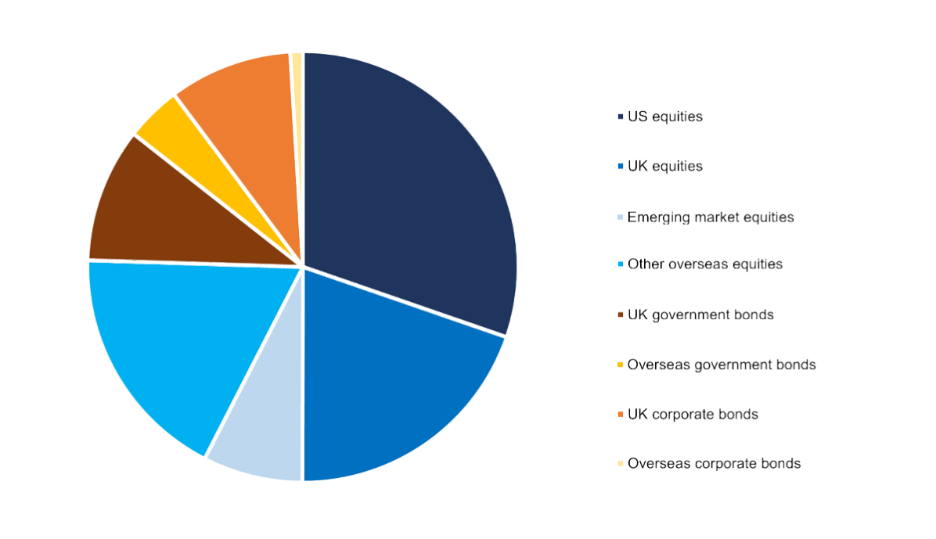

Growth stage

In the early years the fund invests in a well-diversified mix of equities (shares in companies) and bonds (loans to governments or companies), designed to provide the average-risk investor with long-term growth potential.

To keep costs low, the fund uses passively managed investments, which aim to produce returns broadly in line with the markets they track.

Growth stage asset allocation

As at March 2024. Please view the fund factsheet for up to date asset allocation information.

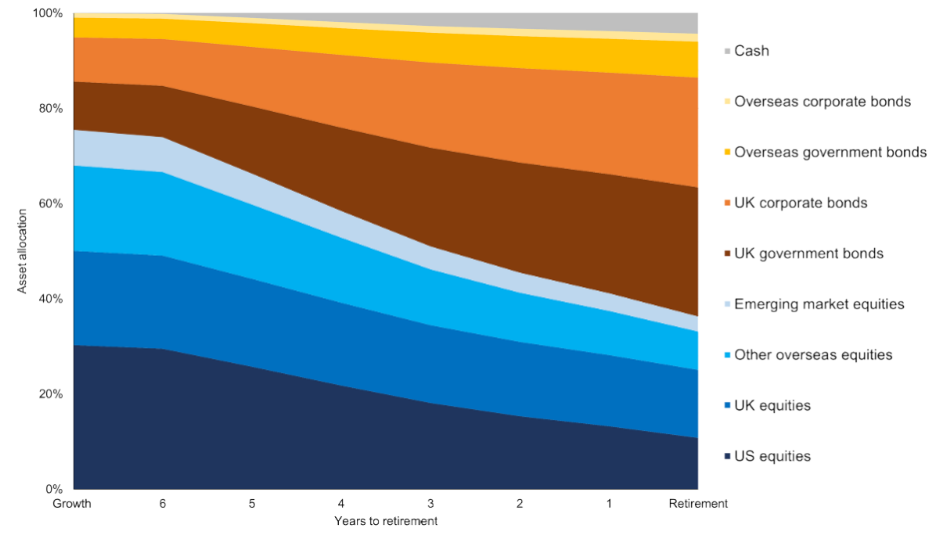

Pre-retirement stage

Six years before investors reach their target retirement date the fund gradually and automatically moves them into investments that are generally considered to be lower risk.

This process, known as the glidepath, continues until the target retirement date is reached.

Glidepath

For illustrative purposes only.

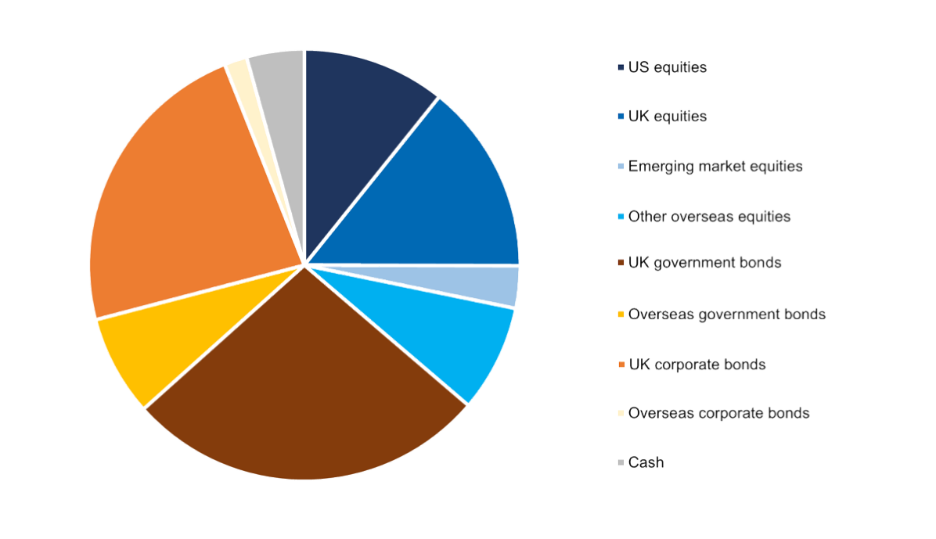

At retirement

When investors reach their nominated retirement age, they remain in the retirement stage asset mix unless they switch to another fund. At this stage, they will be invested in a cautious asset mix that aims to provide continued, moderate growth, with some potential for income generation, so they don't need to make a decision immediately.

This recognises that most investors will tend to stay invested in early retirement, but may choose a variety of ways to build their retirement income.

At retirement asset allocation

As at March 2024. Please view the fund factsheet for up to date asset allocation information.

We regularly review this fund and may change the glidepath strategy or asset mix if we believe it's in the best interests of investors to do so.

How the fund integrates responsible investment factors

We believe that the way we invest can make a meaningful difference, both to investors’ financial futures, and the world we live in.

In 2019 we committed to net-zero greenhouse gas emissions for our pension default fund range by 2050 and to a 50% reduction in emissions by 2030¹. By June 2023, we'd reduced greenhouse gas emissions in this fund by 36%¹.

Today, 78% of the money managed in the growth stage (57% in the retirement stage) of the fund, is in investments that incorporate (ESG) screens (as at 31 March 2024).

Where these ESG screens apply, we exclude companies from the fund that are involved in certain types of industries, for example controversial weapons, tobacco, or thermal coal extraction, and those who have breached the United Nations Global Compact principles.

These are examples only, and not an exhaustive list. In some cases minimum investment thresholds will apply, for example stating that companies must not derive more than a stated percentage of their revenue from excluded activities.

After excluding these types of firms, the asset mix is adjusted to favour companies with stronger ESG scores over companies with weaker ESG scores.

¹Measured using carbon footprint across our full range of default funds. Emissions targets don't apply to individual funds. 2030 target applies to scope 1 and 2 emissions from listed equities and corporate fixed income only.

We reserve the right to make changes to asset allocation both in the growth and retirement stages, and to the length of glidepath to ensure our default fund continues to meet the needs of pension scheme members.

The value of investments may go down as well as up and investors may get back less than they invest.

There is no guarantee that the fund objective will be met.

Find out more

To find out more please open the links below, or speak to your usual Aegon contact.